Invested in Onset.

How we help.

GOVERNANCE

- Parc, through its board influence, assists founders in adding rigour to reporting and decision-making in their business.

- This rigour through our investment adds value by freeing up your time, assisting the business make decisions, and at exit by giving future shareholders confidence in the quality of systems, processes, and financial performance.

STEWARDSHIP

- Parc provides an aligned sounding board and insights to founders that helps set the strategy and steer the course.

- Our stewardship may also involve access to Parc investors and network that can assist you with the challenge or opportunity at hand.

- We are active investors with our own capital invested, so your success is our success.

TECH ENABLEMENT

M&A

- Parc assists founders step change their business and footprint in their industry.

- Our involvement ranges from assisting you identify acquisition and merger opportunities, leading negotiation and due diligence through the transaction, as well as providing support and resources through the integration process.

- Naturally, Parc can further support the M&A journey with additional capital.

MINORITY INTEREST

- Parc does not require control positions in its companies, unlike many traditional investment firms.

- Our fund and co-investment model provides you with greater flexibility, allowing for longer term capital to scale as needed.

- This flexible capital further enables founders and parc to build a long-term partnership.

FOUNDER

ENHANCEMENT

- Providing support to founders is as important as supporting the company.

- We understand what it is like to be in your shoes and can provide a sounding board and mentorship through our partnership.

- Founder enhancement often includes attracting key executives and non-executives to the company to create value and options for founders on exit.

Parc Investment

2023

Investment source

Fund

Investment use

Growth capital

Key milestones

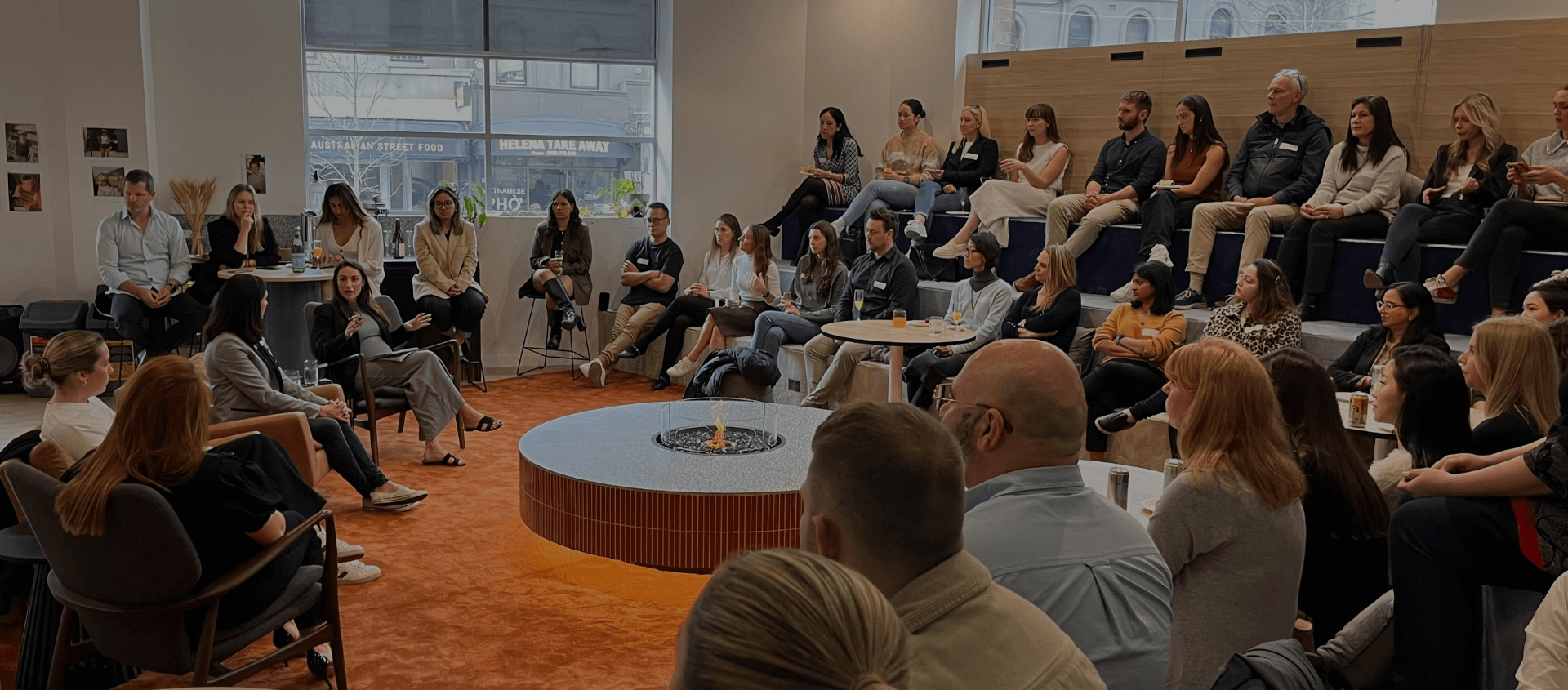

Overview.

Onset is a highly specialised recruitment service provider for higher-value technology roles. Onset offers both permanent and contracting solutions to its client base, which is a mix of local and international blue-chip firms, scale-up and start-up businesses.

Why we invested.

Technology is an always evolving landscape that is becoming increasingly complex and challenging for organisations to navigate in and keep up with their digitalisation needs, driving an iterative and enduring demand for specialist technology talent. Attracting and retaining suitable talent is the key challenge for these organisations and Onset plays a critical role in addressing this issue for government and organisations.

Onset has firmly established its reputation as the go-to source of high-value talent to some of Australia’s most established and well-known emerging companies. As second time operators, its leadership is made up by seasoned industry experts with a proven track record in operating, growing and exiting businesses in this sector.

Why Onset chose us.

Parc worked closely with the founders of Onset for several years, offering ad-hoc strategic advice. When Onset decided to pursue an accelerated growth strategy, Parc was the natural partner of choice, being able to provide a friendly source of capital, strengthen corporate governance, enhance financial rigour, and deliver strategic advice and support